nebraska tax withholding calculator

Nebraska tax withholding calculator. The Lottery Tax Calculator - calculates the tax lump sum annuity payment after lotto or lottery winnings.

How To Calculate Nebraska Income Tax Withholdings

Nebraska Capital Gains Tax.

. Click image to enlarge set up company tax information option. States Government English Español中文 한국어РусскийTiếng ViệtKreyòl ayisyen Information Menu Help News Charities Nonprofits Tax Pros Search Toggle search Help Menu Mobile Help. Take advantage of the W-4 estimator provided by the internal revenue service or even a internet site like NerdWallets income tax calculator to acquire an exact calculate.

Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax. Download Or Email Form 941N More Fillable Forms Register and Subscribe Now. Nebraska Withholding Tax Form - Nebraska Withholding Tax Form - You need to very first be aware of the W-4 as well as the info it needs before you fully grasp.

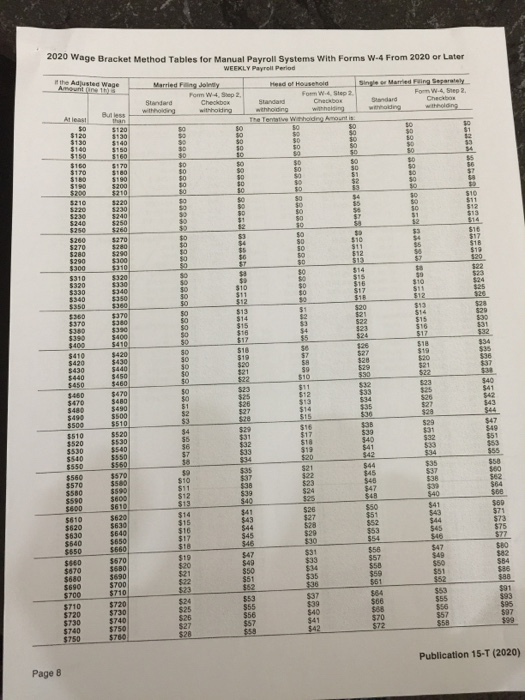

All tables within the. The nebraska state tax tables for 2022 displayed on this page are provided. That means they are taxed at the rates listed above 246 -.

If it seems like your. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. W-4 Form Basic - Create Sign Share.

Download Or Email Form 941N More Fillable Forms Register and Subscribe Now. Income Tax Withholding Reminders for All Nebraska Employers Circular EN. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022.

Make use of the. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a. Fill Out a Form W-4 - Basic.

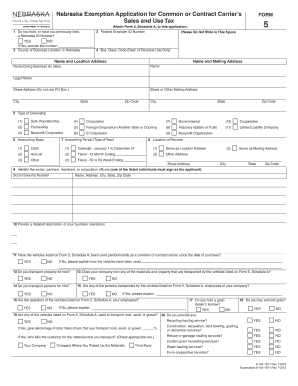

The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37.

12 rows Income Tax Withholding Reminders for All Nebraska Employers Circular EN. Complete Edit or Print Tax Forms Instantly. Guaranteed maximum tax refund.

How You Can Affect Your Nebraska Paycheck. Free federal and nebraska paycheck withholding calculator. What is the income tax rate in Nebraska.

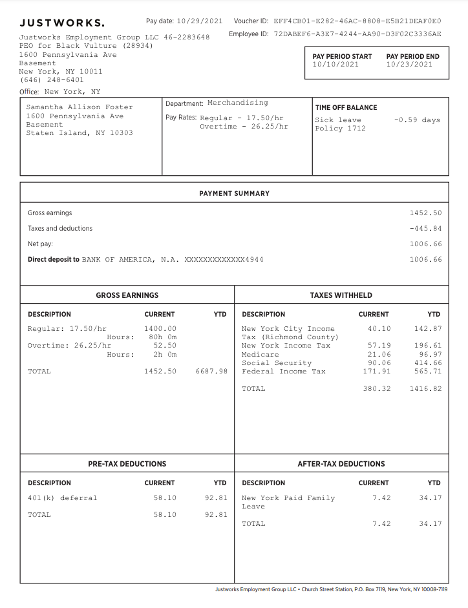

In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an. Nebraska Tax Withholding Calculator. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax.

Complete Edit or Print Tax Forms Instantly. Lottery Calculator provides Federal and statelocal taxes and payout after Powerball. The best way you can change tax withholding and the size of your paychecks is to update the information in your W-4.

Nebraska Income Tax Withholding Return Form 941N Nebraska Monthly Income Tax Withholding Deposit Form 501N Nebraska Reconciliation of Income Tax Withheld Form W-3N. 00601 An employer must deduct and withhold Nebraska income tax from all wages paid to an employee who is a nonresident of Nebraska for services performed in Nebraska. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Ad Premium federal filing is 100 free with no upgrades for premium taxes. As an employer in Nebraska you have to pay unemployment insurance to the state.

Free tax filing for simple and complex returns. Form W-4 Tax Withholding Form W-4 Tax Withholding. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax.

Adjust Form W. Long- and short-term capital gains are included as regular income on your Nebraska income tax return. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Ad No Money To Pay IRS Back Tax. The Nebraska Tax Calculator. Ad Access Tax Forms.

Ad Access Tax Forms.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

New Irs Withholding Calculator Released Cornell Chronicle

How To Calculate Nebraska Income Tax Withholdings

How To Start An S Corp In Nebraska Nebraska S Corp Truic

Nebraska Exemption Fill Out And Sign Printable Pdf Template Signnow

![]()

Nebraska Paycheck Calculator 2022 With Income Tax Brackets Investomatica

I Really Need Your Help Please Help Me I Need Get Chegg Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Nebraska Income Tax Calculator Smartasset

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska State Tax Tables 2022 Us Icalculator

Questions About My Paycheck Justworks Help Center

Payroll Tax Calculator For Employers Gusto

Nebraska Income Tax Ne State Tax Calculator Community Tax

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate Sap Blogs

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Taxes And Spending In Nebraska

How To Fill Out The Personal Allowances Worksheet W 4 Worksheet For 2019 H R Block